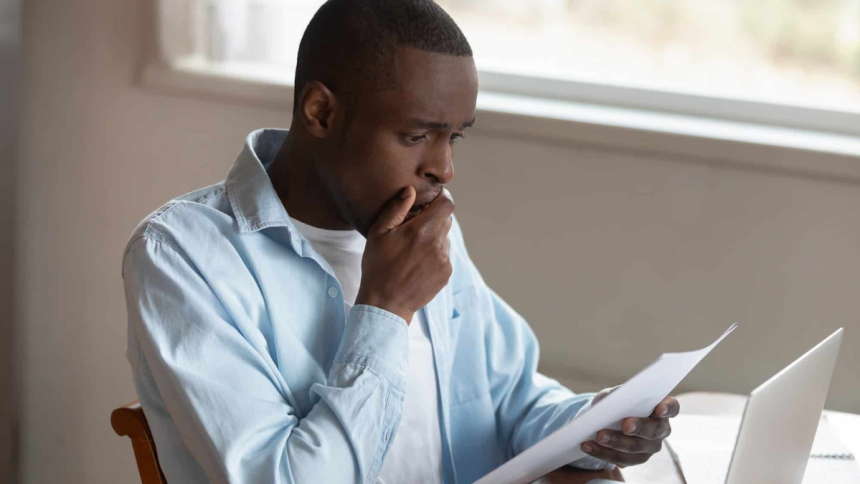

Starting a business is exciting. You’ve got the idea, the hustle, the vision. What you don’t need? Hidden banking fees quietly bleeding your budget dry.

It happens more often than you’d think. A few dollars here, a surprise charge there, and next thing you know, a chunk of your runway has vanished. Let’s talk about how to keep that from happening. Because every penny counts when you’re building from the ground up.

The Sneaky Cost of Banking Fees

Banking fees might seem small. A $15 monthly maintenance fee. A $35 overdraft charge. Even $0.50 for every extra transaction beyond a set limit. Not a big deal, right?

Wrong.

Those small fees add up fast. If you’re not paying attention, you could be handing over hundreds or even thousands of dollars a year, money that could be going into product development, marketing, or hiring.

The truth is that many traditional banks aren’t designed with startups in mind. Their fee structures often assume you’re an established business with a steady income and a cushion to fall back on. But if you’re in your first year? Those fees hit harder.

Why Old-School Banks Can Hurt New-School Businesses

Let’s be real: traditional banks are still catching up to what startups actually need.

They come with legacy systems, outdated practices, and sometimes, a serious lack of transparency. Need to get someone on the phone to resolve an issue? Good luck. Want to move fast and open a new account or set up automation? Not without jumping through hoops.

These institutions also often limit your flexibility. You may face transaction caps, service fees for basic needs, or confusing tiered pricing models. And if you’re not careful, you’ll end up paying for stuff you don’t even use.

So, what’s the alternative?

What to Look for in a Startup-Friendly Bank Account

If you want to bank smarter (and you do), it starts with choosing the right kind of account. One designed for modern businesses.

Here are a few must-haves:

- No monthly fees or minimum balance requirements. You shouldn’t be punished for running lean.

- Unlimited or high transaction limits. Because no one should have to count how many payments they’ve sent.

- Easy integrations. QuickBooks, Xero, Stripe, PayPal, and your bank should play nice with your tech stack.

- Real-time notifications and mobile-first design. You should know exactly where your money is at any time.

Before choosing a bank, research options that prioritize startups with transparent terms and digital-first experiences. Skip the lines, skip the paperwork. These days, you can apply for a checking account online and be up and running in no time. Fast, flexible banking isn’t a perk, it’s a must when every dollar and decision counts.

And while you’re at it, make sure you’re signing up for an account that works for you, not one that quietly siphons off your hard-earned cash.

Use Tools That Help You Stay in Control

You don’t need a CFO to stay on top of your finances, but you do need the right tools.

Today’s best banking platforms come with features that go beyond just storing your cash. You want smart money management:

- Automated alerts that let you know when your balance dips or a big payment hits

- Forecasting tools to help you predict and manage cash flow

- Bill pay automation so you’re never hit with a late fee again

It’s all about keeping your financial house in order without burying yourself in spreadsheets.

Don’t Be Afraid to Negotiate or Look Elsewhere

You’re a startup. That means you have leverage.

Some banks offer special perks for new businesses, but they won’t always tell you unless you ask. Fee waivers, bonus credits, better terms on lines of credit, these are all fair game.

And if your current bank isn’t meeting your needs? Walk.

There are online banks and fintech companies that specialize in serving startups. They move faster, offer more transparency, and often come without the baggage of legacy systems. Think app-first solutions, or banking services built into your existing financial platforms.

Plan for the Growth Stage, Too

Smart banking isn’t just about surviving your first year. It’s also about preparing for what comes next.

As you grow, your banking needs will change. You’ll want to:

- Open separate accounts for operations, payroll, and taxes

- Look into business credit cards or lines of credit

- Streamline international payments if you go global

Planning ahead now means fewer headaches later. The earlier you set up a solid financial infrastructure, the easier it will be to scale when the time comes.

Final Thoughts: Keep Your Money Working for You

Here’s the bottom line: banking should work for you, not against you.

You’re already doing the hard work of building something from scratch. Don’t let outdated banking systems or surprise fees get in your way.

Ask questions. Compare options. Use tools that give you visibility and control.

Most of all, treat your financial systems like you would any core part of your startup: strategically, intentionally, and with an eye on the long game.

Your money should be fueling your business, not quietly draining away behind the scenes.

So take a closer look at your bank account. You might be surprised at what you find. And once you’ve got it dialed in? You’ll have one less thing to worry about on your road to success.

Lynn Martelli is an editor at Readability. She received her MFA in Creative Writing from Antioch University and has worked as an editor for over 10 years. Lynn has edited a wide variety of books, including fiction, non-fiction, memoirs, and more. In her free time, Lynn enjoys reading, writing, and spending time with her family and friends.