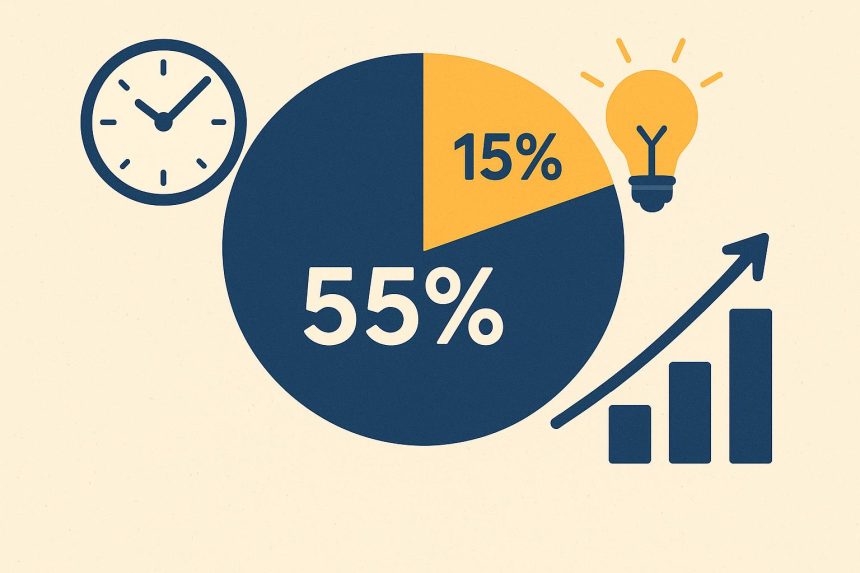

Microsoft employees benefit from comprehensive retirement benefits, but understanding the specific rules governing when you can access these benefits is essential for effective retirement planning. The Microsoft 55 15 retirement rule represents one of the most important concepts for Microsoft employees to understand as they approach retirement age. This provision can significantly impact your retirement timeline and the financial resources available to support your post-career life.

For employees who have dedicated years or decades to Microsoft, understanding how company benefits interact with personal retirement savings, Social Security, and other income sources determines when retirement becomes financially feasible and what lifestyle your retirement savings can support.

Understanding the 55/15 Rule

The Microsoft 55/15 rule allows employees who are at least 55 years old and have at least 15 years of service with the company to access certain retirement benefits earlier than would otherwise be possible. This provision can provide important flexibility for employees considering early retirement or career transitions.

Specifically, the rule affects how you can access your Microsoft pension benefits and potentially other retirement benefits. Without meeting the 55/15 criteria, leaving Microsoft before normal retirement age typically means reduced pension benefits or waiting until you reach a specific age to begin receiving benefits. The 55/15 rule potentially eliminates or reduces these penalties, making early retirement more financially viable.

The exact benefits of meeting the 55/15 threshold can vary depending on when you were hired and which specific Microsoft benefit plans you participate in. Microsoft’s benefits have evolved over the years, and different employees may be covered under different plan provisions based on their hire date and benefits elections.

Years of Service Calculation

Understanding what counts toward your years of service is crucial for planning when you might meet the 15-year threshold. Typically, years of service include all time working for Microsoft, but specific rules govern how different types of leaves, transfers, or employment gaps affect the calculation.

Full-time employment generally counts straightforwardly toward service years. Part-time employment may count proportionally or have specific rules about minimum hours worked. Leaves of absence have varying effects depending on whether they’re paid or unpaid and how long they last.

For employees who have worked for companies that Microsoft acquired, whether that service counts toward Microsoft years of service depends on specific acquisition terms and how employment continuity was handled. Some acquired employees’ prior service counts fully, while others may start their service clock from their Microsoft start date.

If you’re approaching the 15-year mark, understanding exactly where you stand and whether any service time questions exist is important. HR can provide your official service calculation, but checking this well before you plan to retire ensures no surprises derail your timeline.

Coordinating with Other Retirement Benefits

The Microsoft 55/15 rule is just one piece of your complete retirement puzzle. Coordinating Microsoft pension benefits with your 401(k), Social Security, personal savings, and any other income sources determines your overall retirement readiness.

Your Microsoft 401(k) account balance represents your contributions plus employer matching contributions and investment growth over your career. Unlike pension benefits, 401(k) funds are yours regardless of when you leave Microsoft, though accessing them before age 59½ typically triggers a 10% early withdrawal penalty unless specific exceptions apply.

Social Security claiming decisions significantly impact retirement income. You can claim reduced benefits as early as age 62, but waiting until full retirement age (67 for most current workers) or even age 70 substantially increases monthly benefits. If you retire from Microsoft at 55 or 56 using the 55/15 rule, you’ll likely need to bridge several years until Social Security benefits begin.

Beyond the Numbers

While understanding the Microsoft 55 15 retirement rule focuses primarily on financial and benefits considerations, successful retirement planning also addresses the non-financial aspects of this major life transition. What will provide meaning and purpose in your post-Microsoft life? How will you structure your days? What relationships and activities will fill the time previously occupied by work?

Many early retirees discover that the psychological and social adjustments of retirement are more challenging than the financial aspects. Having clear plans for how you’ll spend your time, maintain social connections, and find purpose helps ensure retirement satisfaction beyond just financial security.

Getting Professional Guidance

Given the complexity of Microsoft’s benefits, tax considerations, investment management, and overall retirement planning, many Microsoft employees benefit from working with financial advisors who specialize in helping tech industry employees navigate these decisions. Advisors familiar with Microsoft’s specific benefit structures can provide more tailored guidance than generalist financial planners.

Understanding how the 55/15 rule affects your specific situation requires analyzing your unique benefits, service history, and financial circumstances. What makes sense for one Microsoft employee may not be optimal for another, even if they’re the same age with similar service time.

The Microsoft 55/15 rule provides valuable flexibility for employees who have dedicated substantial portions of their careers to the company. Whether this flexibility allows you to retire comfortably depends on careful planning that accounts for all your financial resources, expected expenses, and personal goals for your retirement years.

Lynn Martelli is an editor at Readability. She received her MFA in Creative Writing from Antioch University and has worked as an editor for over 10 years. Lynn has edited a wide variety of books, including fiction, non-fiction, memoirs, and more. In her free time, Lynn enjoys reading, writing, and spending time with her family and friends.