In today’s rapidly evolving digital landscape, the finance industry faces a paradigm shift in customer expectations. With the rise of digital natives and an increased demand for instant, personalized support, traditional customer service models struggle to keep up.

Customers now expect 24/7 availability, real-time responses, and seamless service delivery, which leaves financial institutions scrambling to adapt.

The Changing Landscape of Customer Support

Evolution of Customer Expectations

The digital age has reshaped consumer behavior, giving rise to a new breed of customers who demand convenience, speed, and personalization. According to a recent report, many consumers believe companies have lost touch with the human element of customer service.

This shift in expectations is particularly pronounced in the finance industry, where customers expect seamless, secure, and efficient service delivery across multiple channels—necessitating the adoption of omnichannel customer support software and solutions.

Limitations of Traditional Customer Support

Traditional customer support models, which rely heavily on human agents, face significant scaling challenges to meet the growing demands of the digital age. As customer bases expand, financial institutions struggle to maintain consistent service quality, leading to longer wait times and increased operational costs.

AI-Powered Customer Support Solutions

To address these challenges and meet evolving customer expectations, financial institutions are turning to Artificial Intelligence (AI) to revolutionize their customer support systems.

AI Chatbots and Virtual Assistants

AI chatbots and virtual assistants are quickly becoming popular in the finance industry, providing real-time assistance and handling routine inquiries with unprecedented efficiency. These AI-powered solutions can provide instant responses, freeing human agents to focus on more complex issues.

Benefits of AI Chatbots and Virtual Assistants:

- Real-time assistance: AI-powered chatbots and virtual assistants are available 24/7, providing instant responses to customer queries.

- Handling routine inquiries: These AI solutions can effectively handle routine tasks such as account balance checks, transaction history inquiries, and basic product information, reducing the workload on human agents.

- Improved operational efficiency: By automating repetitive tasks, AI chatbots and virtual assistants significantly enhance operational efficiency, leading to cost savings and improved resource allocation.

- Consistent service quality: AI-driven solutions maintain consistent service quality, regardless of inquiry volume, ensuring a seamless customer experience.

In addition to these benefits, call center AI has emerged as a crucial tool in enhancing customer support. By integrating AI technologies, call centers can manage high volumes of inquiries more efficiently and provide personalized customer interactions. This not only improves customer satisfaction but also optimizes the use of human resources by allowing agents to handle more complex and value-added tasks.

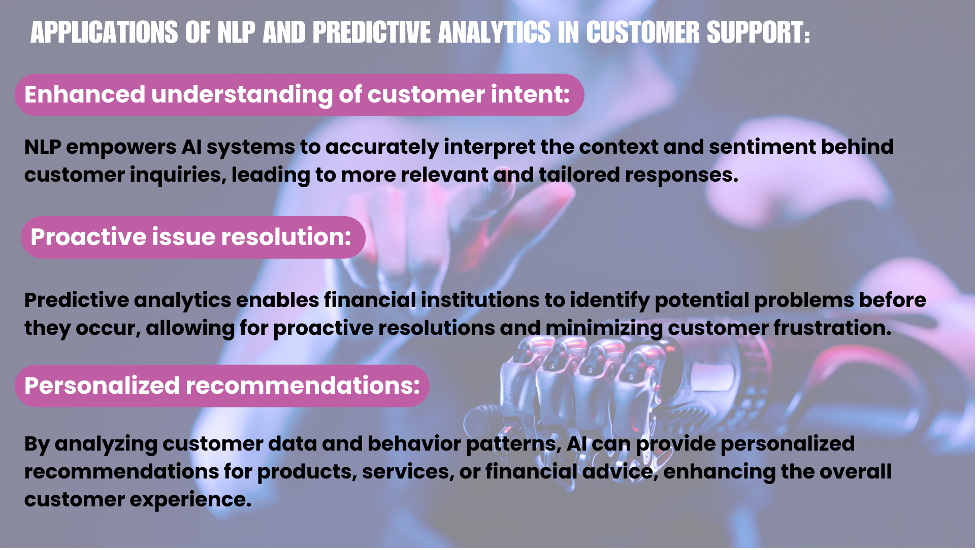

Natural Language Processing (NLP) and Predictive Analytics

Beyond chatbots and virtual assistants, AI technologies like Natural Language Processing (NLP) and predictive analytics are revolutionizing customer support in the finance industry. NLP enables machines to understand and interpret human language, allowing for a more accurate interpretation of customer intent and context.

Predictive analytics, on the other hand, leverages AI algorithms and customer data to anticipate potential issues and provide proactive solutions. By analyzing past interactions, transaction patterns, and customer behavior, financial institutions can offer personalized recommendations and preemptive assistance.

Key Benefits of AI in Customer Support

The integration of AI in customer support systems offers numerous benefits, ranging from enhanced customer engagement and satisfaction to operational efficiency and cost savings.

Enhanced Customer Engagement and Satisfaction

AI’s ability to provide personalized interactions and predictive customer service translates into higher levels of customer engagement and satisfaction. By offering seamless, efficient, and tailored support across all channels, including omnichannel call center software, financial institutions can build trust and foster long-lasting relationships with their customers.

AI-driven customer engagement strategies:

- Personalized interactions: AI algorithms analyze customer data and preferences to deliver tailored experiences, making customers feel valued and understood.

- Predictive customer service: By anticipating potential issues and offering proactive solutions, AI systems can address customer needs before they arise, reducing frustration and increasing satisfaction.

- Secure and efficient service delivery: AI-powered solutions ensure secure and efficient service delivery, meeting the high expectations of customers in the finance industry.

Operational Efficiency and Cost Savings

One of the most significant benefits of AI in customer support is the ability to automate repetitive tasks, freeing up human agents to focus on more complex issues. This automation not only reduces operational costs but also improves resource allocation and streamlines processes.

AI-driven operational efficiency gains:

- Automation of routine tasks: AI chatbots and virtual assistants can handle routine inquiries, reducing the workload on human agents and allowing them to concentrate on high-value, complex interactions.

- Reduced wait times: By quickly addressing common queries, AI solutions minimize customer wait times, leading to improved overall satisfaction.

- Optimized resource allocation: By automating repetitive tasks, financial institutions can reallocate human resources more effectively, maximizing their potential and reducing operational costs.

| AI Solution | Benefit |

| AI Chatbots | Instant responses, handling routine inquiries |

| Virtual Assistants | 24/7 availability, consistent service quality |

| Natural Language Processing (NLP) | Enhanced understanding of customer intent |

| Predictive Analytics | Proactive issue resolution, personalized recommendations |

Challenges and Considerations

While the benefits of AI in customer support are substantial, financial institutions must also navigate various challenges and considerations to ensure successful implementation and long-term sustainability.

Data Privacy and Security Concerns

Because AI systems rely heavily on customer data for personalization and predictive analytics, robust data privacy and security measures are paramount. Financial institutions must comply with regulatory standards and industry best practices to protect sensitive customer information and uphold trust.

Addressing data privacy and security concerns:

- Encryption and data protection: Implement robust encryption protocols and data protection measures to safeguard customer information from unauthorized access or breaches.

- Compliance with regulations: Adhere to relevant data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), to maintain compliance and avoid penalties.

- Balancing automation and human touch: Although AI can automate many tasks, human agents should remain involved in sensitive or complex interactions to maintain customer trust and provide a personalized touch.

Integration and Scalability

Integrating AI solutions into existing systems and ensuring scalability as customer demands and complexities increase can be challenging. Financial institutions must overcome data silos and achieve seamless integration across various platforms and systems to provide consistent and efficient customer support.

Addressing integration and scalability challenges:

- Overcoming data silos: Break down data silos and ensure seamless data integration across different systems and platforms to enable holistic customer insights and personalized experiences.

- Scalable infrastructure: Implement scalable AI solutions that can handle increasing volumes and complexities as customer demands grow, without compromising performance or service quality.

- Continuous improvement: Utilize machine learning and feedback loops to continuously improve and refine AI models, ensuring they adapt to changing customer needs and evolving industry trends.

Future Prospects and Innovations

As AI continues to evolve, the finance industry can expect even more groundbreaking innovations and transformative potential in customer support.

Advanced AI Features

The integration of advanced AI features, such as machine learning and deep learning, will enable continuous improvement and personalization of customer interactions. Additionally, AI can be leveraged for fraud detection, risk management, and personalized financial advice.

Potential applications of advanced AI features:

- Machine learning for continuous improvement: By leveraging machine learning algorithms, AI systems can continuously analyze customer interactions, identify patterns, and refine their responses, ensuring an ever-improving customer experience.

- Deep learning for personalized interactions: Deep learning techniques can process vast amounts of customer data, enabling highly personalized interactions and tailored recommendations based on individual preferences and behavior.

- Fraud detection and risk management: AI can analyze vast datasets and identify anomalies or suspicious patterns, helping financial institutions detect and prevent fraudulent activities while mitigating risks.

- Personalized financial advice: By combining AI’s analytical capabilities with customer data, financial institutions can offer personalized financial advice, investment recommendations, and tailored financial planning services.

Industry Convergence and New Business Models

The integration of AI in customer support is blurring the lines between traditional financial services and technology-driven customer experiences. As AI continues to reshape the industry, we can expect the emergence of new business models and convergence between finance and other sectors.

The potential impact of industry convergence and new business models:

- Blurring lines between finance and technology: Traditional financial institutions may increasingly adopt technology-driven approaches, while tech companies may venture into financial services, creating new hybrid models.

- AI-driven financial products and services: The combination of AI and finance may lead to the development of innovative financial products and services, such as AI-powered investment platforms, personalized insurance solutions, or AI-driven lending services.

- Ecosystem convergence: The finance industry may converge with other sectors, such as retail, healthcare, and transportation, creating integrated ecosystems powered by AI and data-driven insights.

FAQs

1. How does AI improve customer support in finance?

AI enhances customer support by providing real-time assistance, automating routine inquiries, and offering personalized recommendations. This leads to increased efficiency and customer satisfaction.

2. What are the main challenges in implementing AI in financial customer support?

Key challenges include ensuring data privacy and security, achieving seamless integration across systems, and maintaining a balance between automation and human interaction.

3. Can AI completely replace human agents in financial customer support?

While AI can handle many routine tasks, human agents are still essential for managing complex issues and maintaining a personalized customer experience.

Conclusion

By embracing AI and addressing key challenges, financial institutions can unlock transformative potential in customer support. Utilizing AI-powered solutions such as chatbots, virtual assistants, NLP, and predictive analytics enables personalized interactions, operational efficiencies, and cost savings across all channels.

As AI continues to evolve, innovations in fraud detection, personalized advice, and new business models will further revolutionize customer experience in the finance industry.

Lynn Martelli is an editor at Readability. She received her MFA in Creative Writing from Antioch University and has worked as an editor for over 10 years. Lynn has edited a wide variety of books, including fiction, non-fiction, memoirs, and more. In her free time, Lynn enjoys reading, writing, and spending time with her family and friends.