Introduction

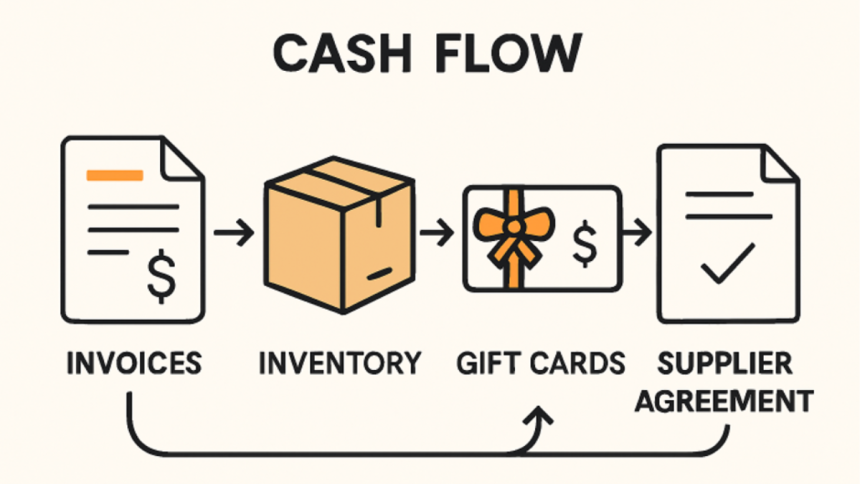

Effective management of cash flow can determine whether a business thrives or struggles. Modern companies are turning to new and creative strategies to ensure a steady financial footing, adapting to changing market conditions and customer behaviors. One such avenue gaining traction is Australian invoice finance?, which unlocks working capital tied up in receivables and injects much-needed liquidity quickly. Innovative cash flow methods, such as incentive-driven revenue acceleration and smart inventory management, can support operational needs and position businesses for growth and resilience in competitive environments, ensuring day-to-day stability and long-term success across various industries.

Implement Early-Payment Incentives

Encouraging customers to pay ahead of invoice due dates is an effective way to accelerate cash inflow. Businesses often use discounts, such as 2% off the total if paid within ten days, to incentivize faster payment cycles. This strategy not only improves liquidity but also reduces the risk of late payments and defaults, ultimately strengthening customer relationships by rewarding their financial responsibility. Early-payment incentives work especially well in industries where client relationships and repeat business are vital for continued success.

Adopt Just-in-Time Inventory Management

Just-in-Time (JIT) inventory is a supply chain strategy that aligns stock purchases more closely with actual demand, which significantly cuts down on inventory holding costs and prevents overstocking. Major companies such as Dell Technologies have used JIT to great effect, only purchasing components or producing goods following actual sales. This frees up cash that would otherwise be tied up in unsold inventory, allowing for greater financial flexibility and more investment in core business activities. Adopting JIT requires careful planning and a reliable supplier relationship, but can lead to improved operational efficiency over time.

Offer Digital Gift Cards and Prepaid Packages

Digital gift cards and prepaid packages allow businesses to receive cash upfront for goods or services that will be delivered in the future. This immediate inflow helps stabilize cash reserves and enhances planning accuracy. Starbucks, for example, built its rewards program on customers preloading funds onto digital cards, which unlocked a steady stream of operating capital. Even smaller businesses have found success by promoting gift card sales during seasonal periods or offering value-added bundles, providing a benefit for both customers and company finances.

Negotiate Extended Supplier Terms

Proactive negotiation with suppliers can create extra breathing room in your cash cycle. Shifting from 30-day payment terms to 60 or even 90 days lets you hold onto cash for longer, which can be pivotal during lean periods or while ramping up growth initiatives. Strong relationships and transparent communication with suppliers are essential here. Suppliers can be more accommodating if you can demonstrate reliability and mutual benefit over the long term. Extended terms give you flexibility to deploy capital on critical operational needs while maintaining trust and continuity in your supply chain.

Automate Invoice Reminders and Follow-Ups

Automation in finance processes can drive significant efficiency gains. For instance, many businesses employ cloud-based accounts receivable software or plugins that send automatic reminders and escalations to customers once invoices become overdue. This proactive approach ensures fewer overdue accounts, speeds up collections, and reduces the manual labour involved in chasing payments. According to SHRM, automation can also reduce human error and free staff to focus on higher-value tasks.

Lease Rather Than Buy High-Cost Equipment

Leasing allows businesses to obtain the equipment they need without large upfront expenditures, preserving precious cash reserves. This is especially advantageous for capital-intensive industries or startups experiencing rapid growth. Leasing agreements often include maintenance, upgrades, or the flexibility to swap equipment, which can reduce unexpected expenses. For example, a craft brewery that leased its canning line was able to scale production and distribution without the heavy burden of a massive initial purchase, ensuring consistent output while retaining cash for other investments.

Implement Dynamic Pricing During Peak Demand

Dynamic pricing involves adjusting prices in real time according to demand, peak periods, or market fluctuations. This approach has become standard in industries such as hospitality, airlines, rideshares, and increasingly in retail. Restaurants boost menu prices on busy weekends, while e-commerce stores roll out surge pricing during viral product launches. Effective use of dynamic pricing requires robust data analysis and a clear understanding of customer purchasing patterns. Businesses that implement this strategy can maximise their revenue potential, smooth out cash flow variability, and stay competitive against more agile rivals.

Liquidate Excess Inventory Through Flash Sales

Excess inventory can strain capital and take up valuable warehouse space. Flash sales, short, publicized events offering deep discounts, can quickly convert surplus goods into cash. For instance, organizing an annual “Warehouse Super Sale” helped clear stagnant products, ease storage costs, and reinvest in high-demand merchandise. These cash flow strategies help businesses remain agile, resilient, and ready for growth by blending incentive-driven approaches, digital solutions, and process optimizations.

Lynn Martelli is an editor at Readability. She received her MFA in Creative Writing from Antioch University and has worked as an editor for over 10 years. Lynn has edited a wide variety of books, including fiction, non-fiction, memoirs, and more. In her free time, Lynn enjoys reading, writing, and spending time with her family and friends.