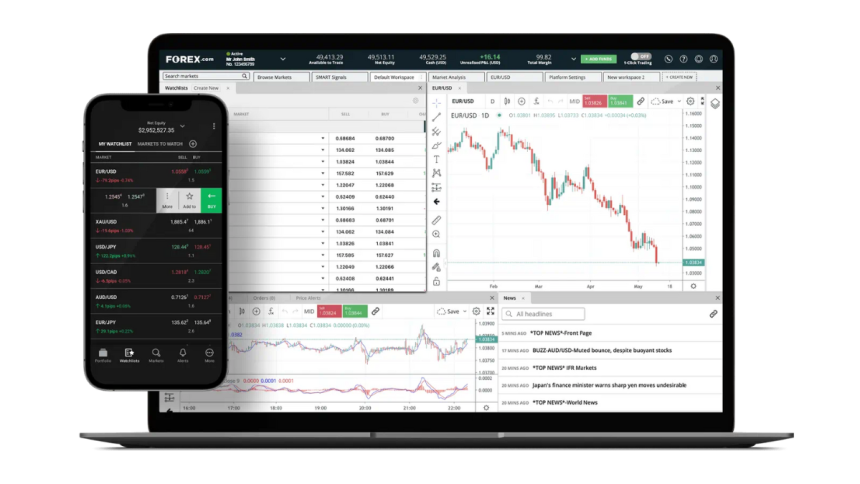

The foreign exchange market, or forex, stands out as one of the most dynamic and globally impactful financial markets in the world. For anyone looking to succeed in forex, having access to the right trading platforms for forexis essential. But what makes a trading platform truly valuable? The answer lies in the benefits offered by features like advanced charting tools and robust risk management systems. These tools are the backbone of smart and strategic trading, equipping traders to make informed decisions while minimizing potential losses.

This article dives into the benefits of using trading platforms equipped with charting tools and risk management features. By the end of this read, you’ll understand why these platforms are essential to successful trading and how they support you in navigating the fast-paced world of forex.

The Importance of Charting Tools in Forex Trading

The forex market is fast-moving and heavily dependent on data analysis. Charting tools are a primary component of any successful trader’s arsenal, offering key insights into market trends, price movements, and overall liquidity. Here’s why these tools matter.

Enhance Decision Making With Visualized Data

Numbers shift rapidly in the forex market. Charting tools visualize this data, offering a clear picture of trends and market movements. Through line charts, candlestick charts, and bar charts, traders quickly understand the mechanics of trading pairs. These visual representations allow traders to identify patterns and opportunities at a glance, empowering them to make timely and informed decisions.

Historical Data for Comprehensive Analysis

Charting tools provide access to historical price data, which is invaluable for forecasting. By analyzing past performance trends, traders can anticipate future movements. For instance, spotting recurring patterns or trends over days, weeks, or even years helps anticipate repeating behaviors, guiding traders toward more predictable outcomes.

Multiple Indicators for Precision

Charting tools integrate indicators like moving averages, Relative Strength Index (RSI), Bollinger Bands, and Fibonacci retracements. These indicators layer additional insights atop raw price data, helping traders pinpoint ideal entry and exit points. Having access to customizable tools improves accuracy and aids in crafting strategies tailored to individual preferences and styles.

Real-Time Insights for Fast Action

Forex trading operates 24/5, making it crucial to have access to real-time data. Platforms with advanced charting tools provide live updates to reflect every tick in the market. Being able to react swiftly is a major advantage, and these real-time insights ensure traders remain ahead of the curve.

How Risk Management Features Benefit Forex Traders

While profits can be enticing, forex trading also comes with risks. Risk management features within trading platforms are designed to safeguard traders against undue losses and build a stable long-term trading strategy. Here’s how they work.

Minimize Losses With Stop-Loss Orders

Stop-loss orders are essential in controlling potential losses in volatile market conditions. Traders can set specific price points at which an open position will automatically close, ensuring losses are capped. This feature allows traders to protect their capital and maintain emotional discipline, avoiding drastic decisions under pressure.

Lock in Profits With Take-Profit Orders

Just as stop-loss orders control downside risk, take-profit orders are an equally vital tool for locking in gains. These orders automatically close a trade when a specific favorable price point is reached. By doing so, traders secure profits before market reversals can erode them.

Maintain Balance With Leverage Controls

Leverage is a double-edged sword in forex trading. While it amplifies profits on successful trades, it can also magnify losses. Risk management features often include tools to manage leverage effectively, ensuring traders don’t overextend themselves. This reduces the likelihood of ending up on the wrong side of large-scale losses.

Position Sizing for Long-Term Strategy

Many platforms offer features to calculate position sizing based on the trader’s risk tolerance and available capital. Proper position sizing ensures traders allocate resources wisely, maintain diversified portfolios, and lower their exposure to high-risk trades. This disciplined approach is pivotal for long-term success in forex.

The Combined Power of Charting Tools and Risk Management

Pairing charting tools with robust risk management creates the perfect combination for effective trading. Here’s how these two features work together to bolster a trader’s strategy.

Data-Driven Risk Assessment

Using charting tools to identify trends and patterns allows traders to craft informed strategies. Combine this with risk management features, and you have a comprehensive setup where data-based insights help mitigate risks. For example, a trader might use charts to identify support and resistance levels before setting stop-loss and take-profit orders accordingly.

Strategic Planning Made Simple

Successful forex trading is all about strategy. Charting tools provide the necessary insights, enabling traders to design specific plans involving risk controls like position sizing and leverage limits. This integration ensures consistency, reduces the temptation for impulsive trading, and optimizes potential returns as compared to random trading decisions.

Confidence in Volatility

Forex is inherently volatile, and it takes resilience to succeed. Armed with the right tools, traders gain confidence even in unpredictable markets. For instance, they can rely on real-time chart updates to identify opportunities while letting pre-set risk management measures take care of potential pitfalls.

Adaptability Across Markets

The forex market is influenced by global events, economic shifts, and political policies. Trading platforms with combined charting and risk management tools allow traders to adapt quickly to changes. This dual approach ensures that no matter what market conditions arise, traders are better equipped to respond strategically.

Supporting Every Trader’s Journey

No two traders are the same, and trading platforms with advanced features are designed for versatility. Whether you’re a beginner entering delicate trades or an experienced trader managing a significant portfolio, these tools make the trading experience smoother.

For Beginners

Novice traders benefit from the intuitive interface of charting tools. They can learn basic trends, practice with demo accounts, and refine their understanding of forex markets. Risk management features provide an added safety net, offering peace of mind while navigating the initial stages of trading.

For Experienced Traders

Advanced users rely on intricate chart setups and customized indicators to plan complex trades. With risk management features, they can focus on executing their strategies without compromising long-term capital. The combination of scalability and precision makes these platforms ideal for sophisticated trading plans.

Lynn Martelli is an editor at Readability. She received her MFA in Creative Writing from Antioch University and has worked as an editor for over 10 years. Lynn has edited a wide variety of books, including fiction, non-fiction, memoirs, and more. In her free time, Lynn enjoys reading, writing, and spending time with her family and friends.